The Biggest Retirement Fears (And How to Overcome Them)

Humans have fears but of different kinds. Some are afraid of snakes, while some are terrified of spiders. Some are afraid of darkness, while some fear clowns. You too probably must have your fears. People closing in on their retirement age have their fears – the fear of the times that lie ahead and the fear of the uncertainty. If you are one of them, certain concerns will keep you awake at night. A retirement period can be a cakewalk. A retirement period can be menacing too. There are a few of the retirement fears that people usually have when they are about to call it a day. Hopefully, you would find something in common.

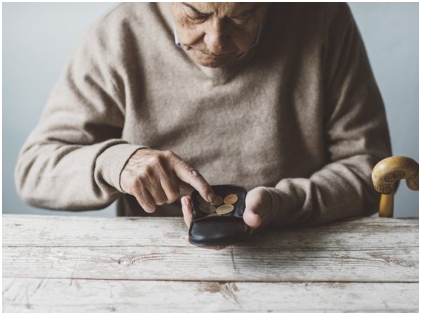

Running Out of Money

This is probably the greatest fear one has in retirement. Around 52% of the workers revealed that they are highly concerned about outliving their earnings as well as all the investments they have made. 42 to 42% of the people have fears that they wouldn’t be able to burden the basic monetary needs that a family might have.

This is probably the greatest fear one has in retirement. Around 52% of the workers revealed that they are highly concerned about outliving their earnings as well as all the investments they have made. 42 to 42% of the people have fears that they wouldn’t be able to burden the basic monetary needs that a family might have.

There’s no need to mention that these are genuine fears, and it’s pretty normal for one to have them. Running out of money and not being able to work owing to old age is something which can snatch away all the peace from your life. The ever-rising medical bills will be a dreadful headache. So what do you do to stay safe from worries? Pen down a proper retirement plan. Always remember that when you have stepped into your retirement period, you need to have a set of resources, at least for the forthcoming twenty to thirty years.

Social Security Will Be Reduced

If you are nowhere your retirement age and are still banging your head against the wall thinking about down at the fate of Social Security, you need to sit down and talk with a financial expert once you retire. You can also chart out a proper retirement plan without any loopholes.

If you are nowhere your retirement age and are still banging your head against the wall thinking about down at the fate of Social Security, you need to sit down and talk with a financial expert once you retire. You can also chart out a proper retirement plan without any loopholes.

Calculate what your expenditures can be once you retire. Also, think about the amount of savings you should have in your pockets around that time. If you are already in retirement or are on the verge of retiring, your benefit will probably get all the protection it needs. Remember that when you have stepped into your retirement period, you need to have a set of resources for the forthcoming twenty to thirty years.

Health And Healthcare

Health and healthcare is a major concern that people have to stand at the doorstep of retirement. Declining health and long term care are the issues that keep on playing at the back of their minds. No one knows what kind of ailment would strike them at what point of time. There is no guarantee that one would be in the pink of health lifelong. Therefore, one needs to be completely prepared for the dark times and sort out their health insurance policies.

Health and healthcare is a major concern that people have to stand at the doorstep of retirement. Declining health and long term care are the issues that keep on playing at the back of their minds. No one knows what kind of ailment would strike them at what point of time. There is no guarantee that one would be in the pink of health lifelong. Therefore, one needs to be completely prepared for the dark times and sort out their health insurance policies.

The average expenses that a 65-year-old might have to pay from their pockets are something in the proximity of $260,000, and this figure doesn’t comprise long-term care costs. Hence, that’s a cause of concern for sure. A retirement planner might help you out in this scenario. Aside from that, your healthcare expenses might also depend on where you live. This also makes your access to healthcare tougher. Focus on your health, try to find out how you can afford the future healthcare costs, and talk to an expert regarding what you can do to get optimum healthcare access.

In Conclusion

Retirement is something that you haven’t experienced in the past. Therefore, it’s completely a different ball game. Things won’t remain the same anymore. Whatever plans you might have made about your finances before retirement might go for a toss. It can also be emotionally challenging for you.

You have to try your best and get past the hurdles. Once you overcome your fears, things would automatically be a cakewalk for you. So, write down a retirement plan today. This will give you the courage to fight the challenging times that are awaiting. Keep in mind, you are the one who can bail you out and allay the fears. Always consult with your financial advisor and family before you take a big leap in your retirement.

More in Business & Finance

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login