Redeeming Your Savings Bonds – Here’s What You Need to Know

Today, savings bonds stand out as a steadfast option for many Americans. If you are pondering over the process of U.S. savings bonds redemption, you have landed on the right page. This guide will escort you through what U.S. savings bonds are, how they operate, and, crucially, how to redeem them.

Time / Essentially, U.S. savings bonds are government-issued securities that offer a risk-free way to save money.

You lend money to the U.S. government, and in return, it agrees to pay you back with interest after a certain period. Sounds straightforward, right? Well, they are! These bonds are hailed for their safety, making them a favorite among conservative investors.

How Do U.S. Savings Bonds Work?

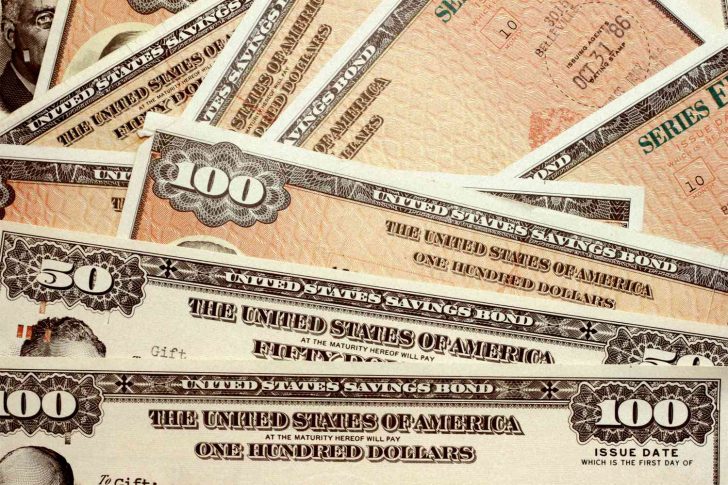

U.S. savings bonds work by paying interest that compounds semi-annually. There are two main types of savings bonds available: Series EE and Series I. Series EE bonds are purchased at face value and promise to double in value over 20 years. On the other hand, Series I bonds are inflation-indexed, meaning they offer a fixed rate plus an adjustment for inflation, making them an appealing choice during times of economic volatility.

Finance Corner / Series EE and Series I are the two major types. And your U.S. savings bonds redemption will be determined based on the types of bonds you have.

One of the perks of these bonds is their tax advantages. The interest earned is exempt from state and local taxes, and federal taxes can be deferred until you redeem the bond or it reaches maturity.

A Step-by-Step Guide to U.S. Savings Bonds Redemption

Now, let’s get to the heart of the matter: U.S. savings bonds redemption. Redeeming your bonds is a straightforward process, but there are a few key points to keep in mind.

Tax Considerations

Remember, the interest earned from U.S. savings bonds is subject to federal income tax, though it is exempt from state and local taxes. When you redeem your bonds, you will receive an IRS Form 1099-INT, which you must report on your federal income tax return.

Planning for this tax event can help manage any potential impact on your finances.

Know When to Redeem

Timing is crucial when it comes to redeeming your savings bonds. While you can cash in a bond after 12 months of purchasing it, doing so before it matures (usually 30 years) means you might miss out on additional interest earnings. Also, if you redeem your bond within the first five years, you will forfeit the last three months of interest as a penalty.

Marca / Before redeeming, it is wise to check the current value of your bond. You can easily do this online through the TreasuryDirect website by using their Savings Bond Calculator.

This step ensures that you are fully aware of how much you will receive upon redemption.

Where to Redeem Your Bonds?

Electronic bonds can be redeemed directly through the TreasuryDirect website, which is convenient and quick. For paper bonds, you can visit most local banks and financial institutions. It is a good idea to call ahead and confirm they offer this service. Be prepared to present identification.

However, if you are redeeming a bond that is not in your name, additional documentation may be required.

Why Redeem Your Savings Bonds?

The decision to redeem your savings bonds could be motivated by various reasons. Perhaps you need the funds for a significant purchase, educational expenses, or as part of your retirement strategy. Or maybe your bonds have matured. And it is simply time to cash them in.

So, whatever your reason, understanding the redemption process ensures that you can make the most out of your investment.

More in Loans & Mortgages

-

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023 -

`

Top 6 Best Housing Options for Older Adults

As we grow old, our physical and mental health needs change. In turn, this means that we require more assistance from...

September 21, 2023

You must be logged in to post a comment Login