How to Seek a Loan for a Used Car! Here Are Some Tips to Consider Before You Buy One!

They say the value of a car dips down as soon as it ventures out of a showroom! Loans for new and used cars have almost similar terms. But it’s important to look under the veneer and see what you are getting. A new car loses 10 percent of its value as soon as you zoom off with it. It may lose another 10% after a year. That means there is a crash of 20% of the car’s value in the first 12 months. That’s why experts tell you it is best to buy at least a year old and let the next user get the 20% depreciation hit.

They say the value of a car dips down as soon as it ventures out of a showroom! Loans for new and used cars have almost similar terms. But it’s important to look under the veneer and see what you are getting. A new car loses 10 percent of its value as soon as you zoom off with it. It may lose another 10% after a year. That means there is a crash of 20% of the car’s value in the first 12 months. That’s why experts tell you it is best to buy at least a year old and let the next user get the 20% depreciation hit.

Sometimes the used cars may look as good as the real ones, barring, of course, a few wears and tears or the number of miles it has eaten up. However, the only problem is finding it difficult to find financing for the car. If you find it difficult to find finance for your car, here are some tips to help you with that.

Understand Your Credit Score

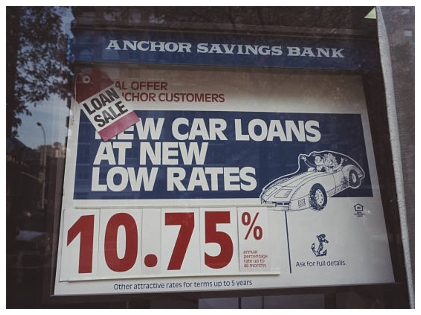

Financing a car and getting a mortgage for the same isn’t the same thing. You can get yourself a car loan even if your credit score looks bad. The only issue to ail you is that you may have to endure a higher interest rate if you have little to no credit. When the dealerships state that they have very low-interest rates, they usually mean it is one with a FICO credit score of 700 or over. People who have a lower credit sometimes may face trouble in getting a good financer.

Compare Quotes

Browse more before selecting an excellent dealership or company and get good quotes for everyone who may give you a loan. Shopping for a financing company is like making any other big purchases in life. You should compare the loan amount, and the term duration, and the interest rate they’re offering to get the best deal. Only then can you go ahead and sign the dotted line.

Take Short-Term Loans

Many people think that having a longer loan duration may mean lesser monthly burdens. They can not be further from the truth. A shorter loan term may mean you will end up saving money in the long run.

Paying off the loan faster may also mean paying a lower interest over time. We get it. It is always tempting to stretch payments for five years or more, but it may cost you more as the interest increases. Also, you may get a car that isn’t worth the price by the time you end up paying off the loan.

Pay Maximum Down Payment

One most important tip for anyone purchasing a vehicle is that you may have to pay off at least 20% of the total price as a down payment. When you pay more money, it may be taken as an initial loan. This may not only impact the payments, but it may also impact the interest rate. If you save more and save more money, say 20% down or more, you may finally save more money in the long run.

Pay The Major Chunk as Cash

Other fees that you need to be mindful of are paying the dealership fees to documentation fees, and there is always sales tax to consider when you go about to purchase a vehicle. Consider thinking of paying off the fees and taxes in cash rather than letting it affect your loan.

Other fees that you need to be mindful of are paying the dealership fees to documentation fees, and there is always sales tax to consider when you go about to purchase a vehicle. Consider thinking of paying off the fees and taxes in cash rather than letting it affect your loan.

Dealerships are forthcoming to add these fees to your loan or may offer to pay off sales tax. But this may only increase the loan amount. Not only that, but you may also have to pay off the additional interest on the amount you add to the sales tax.

Get a Non-Recourse Loan

If you happen to default on a loan, the financing company may end up repossessing your car. Sometimes, the car may not be worth the residual amount left of the loan, so that you may end up with a deficit. In such a situation, a non-recourse loan may protect you. In case you default on a non-recourse loan, you may have to pay the difference, and you may not have an asset that is valuable enough to cover the loss.

Consider these options while you choose the right financing company to get a smooth ride, henceforward. Good luck!

More in Loans & Mortgages

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login