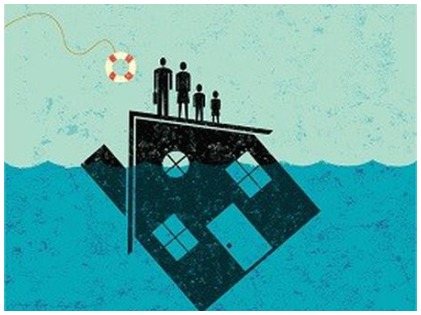

Can’t Meet Your Mortgage Commitment? We Have A Couple Of Solutions for You!

If you happen to be battling to get your mortgage payments out especially at a time like this, you sure aren’t alone. Many people now find themselves in challenging circumstances. And that’s because one or more breadwinners in the household have lost their jobs or might lose them soon. Business owners are facing dips in income with the restrictions of the lockdowns across the globe.

If you happen to be battling to get your mortgage payments out especially at a time like this, you sure aren’t alone. Many people now find themselves in challenging circumstances. And that’s because one or more breadwinners in the household have lost their jobs or might lose them soon. Business owners are facing dips in income with the restrictions of the lockdowns across the globe.

People’s lives are changing. And, understandably, there is a surge in the number of homeowners who cannot meet their mortgage commitments. And this is causing numerous financial strains. Fortunately, we have seven solutions for you to escape the financial rut, coronavirus, or not!

Ask For Mortgage Forbearance

Many mortgage lenders are now offering mortgage forbearance to their borrowers if the current coronavirus pandemic financially strains them. The forbearance is typically for 12 months. This means that borrowers can suspend their mortgage payments or reduce them if preferred, during these 12 months. In addition to this, any mortgage delinquency wouldn’t be sent off to the credit bureaus to label you as blacklisted. Once the forbearance passes, lenders will then work together with borrowers to modify the mortgage loans to lower the monthly payments, should need be.

Refinance Over a Longer Term

You can get out of your payment issues by spacing your loans over longer periods. It will thereby lower your monthly payments. By refinancing with the longer term, you need to understand that your interest rate is likely to increase and your payback amount will increase as well. But if cash flow is a real issue it can get you out of the crunch. When you find yourself in greener pastures, you can offset these disadvantages by paying in extra each month. It will help you knock off some of the principal amounts.

Challenge Property Tax

If the value of houses in your area drops, you can challenge the property tax to get some relief. First, you have to contact the county tax assessor’s office to obtain the necessary information. You will need this to prove that the value of your home has dropped. This is, however, a short-term fix. That’s because, when your property value increases, this solution isn’t viable.

If the value of houses in your area drops, you can challenge the property tax to get some relief. First, you have to contact the county tax assessor’s office to obtain the necessary information. You will need this to prove that the value of your home has dropped. This is, however, a short-term fix. That’s because, when your property value increases, this solution isn’t viable.

Modify Your Mortgage Loan

A mortgage loan modification is an alternative for people who don’t have the option of refinancing. Yet still, they need help to make their payments. Loan modification differs from refinancing. That is because it requires hardship. This means that borrowers should provide proof of their financial hardships to the lenders. It’s a very time and labor-intensive process with plenty of documents but eventually, the borrower receives counseling through a certified organization to understand all the options available to them. Unfortunately, not all lenders offer the option of modification, or may only offer short-term modifications.

Eliminate Private Mortgage Insurance

While this solution is dependent on how much equity you have in your home. It can be a great help in reducing monthly payments if you qualify for it. Typically, when borrowers have about 20% of their equity in the property, they may contact their lender and discuss the option of dropping private mortgage insurance. People who don’t pay down payments on homes generally have to pay for private mortgage insurance for about two years, at minimum. However, there are many exceptions to the two-year general rule that exists. Therefore, look into this option and determine whether it is viable, especially if you have made improvements to the home.

While this solution is dependent on how much equity you have in your home. It can be a great help in reducing monthly payments if you qualify for it. Typically, when borrowers have about 20% of their equity in the property, they may contact their lender and discuss the option of dropping private mortgage insurance. People who don’t pay down payments on homes generally have to pay for private mortgage insurance for about two years, at minimum. However, there are many exceptions to the two-year general rule that exists. Therefore, look into this option and determine whether it is viable, especially if you have made improvements to the home.

No matter which route you choose to remedy your situation, the very first thing you should be doing is calling your mortgage loan provider. Try to contact your provider before missing any payments. This will help you keep most of your options open, in case you have to take advantage of them for some time until you get back onto your feet.

Many people are in financial trouble this year, so don’t feel alone and like you have no options. It will take you by surprise to know how lenient most providers are in light of the coronavirus outbreak! Your finances will bounce back eventually. For now, make the right choices to keep afloat. Eventually, you will be able to save and strike the right financial balance. So, don’t ever lose hope, things will surely fall into place!

More in Loans & Mortgages

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login