Tax Facts for the Unemployed: What You Need to Know During the Pandemic

Like most parts of the world amid the coronavirus pandemic, things are getting shaky in the United States as over 30.3 million Americans have filed for unemployment in the past six weeks, according to data from the U.S. Department of Labor. That’s around 18.6% of the US labor force. Before businesses had to lay off or furlough employees due to city shutdowns, there were already roughly 7.1 million unemployed Americans.

To help Americans in this crisis, U.S. President Donald Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (or CARES Act) on March 27. It introduces an expansion of unemployment benefits that also cater to self-employed, part-time, and gig workers. The amount that an unemployed person can get varies depending on their state, but it’s usually about 50% of their prior income. Under the new law, benefits are now payable for 39 weeks, longer than the usual 26-week period in most states before CARES.

Unemployed Americans can also get an additional pay-out from the federal government amounting to $600 per week until July 31, 2020. Each state has its guidelines regarding eligibility. But usually, those who are unemployed through no fault of their own are qualified—provided that they can meet the work and wage requirements set by their state.

The over 30 million unemployed Americans may be able to qualify for unemployment benefits from the CARES Act.

Aside from knowing what the benefits are and if you are eligible, there are also a lot of other things that should be considered. This includes how to pay the bills, figuring out unemployment benefits, and getting a new job.

As more and more people are now getting worried about their employment prospects and finances, another thing that causes much concern is taxes. To ease things, here are several tax-related facts that could help you in making financial decisions in the time of the pandemic.

1) Unemployment compensation is taxable

The state benefits and the $600 payment you receive is taxable for federal income tax purposes. The amount will be reported to you via the Form 1099-G. So before spending your benefits, think about the consequences first.

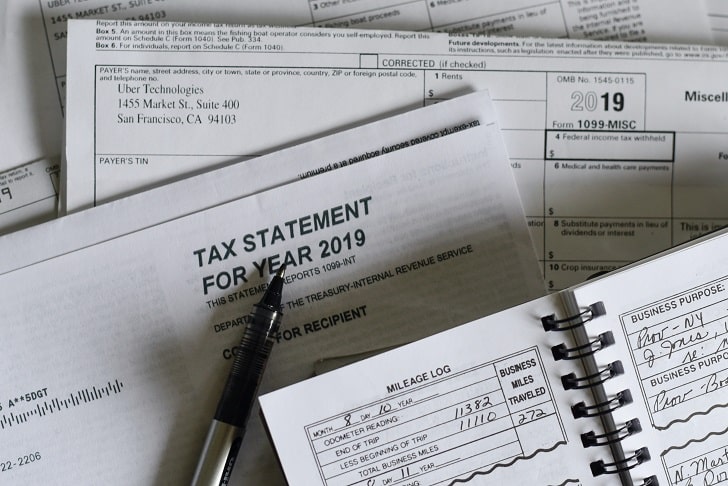

2) The deadline for filing of 2019 income taxes is moved to July 15

The due date for filing your documents for 2019 taxes is supposed to be April 15, 2020. However, the government has pushed the date to July 15, 2020. Aside from the extended tax filing and payment date, penalties and interest for any payment due on April 15 will be waived. To lessen your worries about the amount of taxes you have to pay, you may want to consider making estimated payments within the year.

Americans are given three more months to file their 2019 income taxes

3) Withdrawals from pension or retirement plans are taxable

Any withdrawal from your pension or retirement plan is subject to taxes unless it is transferred to a qualified plan such as an IRA. Because of the CARES Act, you are not required to pay for the entire tax amount in one go but have three years to do so. It’s better to consult a tax professional or benefits administrator before handling retirement income or accrued benefits as these can be tricky.

4) Zero penalties for withdrawals of up to $100,000 from your 401(k) or IRA

You won’t be able to withdraw from your 401(k) or IRA before you reach the age of 59-and-a-half. But in 2020, if you have no choice but to get extra cash from your retirement account, you can withdraw up to $100,000 without having to pay the usual 10% early withdrawal penalty. However, you still have to pay taxes for your withdrawal (refer to #3).

You can withdraw up to $100,000 from your retirement account, but it is subject to taxes

5) Taking a loan against your 401(k) is possible

The new law enables unemployed Americans to borrow up to 100% of their 401(k) account or $100,000—depending on whichever is lesser—until September 23, 2020. You can defer your repayment for up to a year and will have five years to pay the amount without being taxed. The law permits the changes but does not mandate it, so it’s better to check with HR as rules may vary depending on your plan.

More in Business & Finance

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login