Why Should You Have Multiple Bank Accounts?

The best way to fortify your wealth and avoid debt is to make a foolproof plan saving as much money as you can. That way, you can to your future needs and desires. However, you need to be wary of handling your savings and your financial habits. Some financial experts set up simple savings accounts linked to your checking account.

The best way to fortify your wealth and avoid debt is to make a foolproof plan saving as much money as you can. That way, you can to your future needs and desires. However, you need to be wary of handling your savings and your financial habits. Some financial experts set up simple savings accounts linked to your checking account.

Others advocate opening multiple accounts to meet various savings targets. Your final decision depends a lot on your financial personality. Nowadays, you can open online bank accounts just about anywhere within a couple of minutes. But should you have multiple savings accounts? Check out why you should.

For Reaching Your Financial Goals

The main reason why you need to open more than one account and track exactly how much you have saved toward each of the individual savings goals. For example, suppose your goal is to save three months’ worth of income in an emergency account, put money aside for a down payment on a house, or even fund your summer vacation. In that case, you can open three accounts to keep a tab on exactly how close you are to your goals.

Separate Your Savings

You need to keep a certain amount of money as a lock-down, so you need it if you face any emergency. Keep an emergency fund in an account that you can easily access and store the rest of your funds in accounts with short- and long-term targets.

Make Regular Withdrawals.

Money market accounts and savings accounts are usually linked to six monthly withdrawals. However, if you open three such accounts, you can withdraw the money 18 times per month. Just ensure that the money you withdraw makes further investments or is applicable to meet your specific savings goals. Otherwise, you may end up depleting your accounts.

Money market accounts and savings accounts are usually linked to six monthly withdrawals. However, if you open three such accounts, you can withdraw the money 18 times per month. Just ensure that the money you withdraw makes further investments or is applicable to meet your specific savings goals. Otherwise, you may end up depleting your accounts.

Automate Your Savings.

If you have multiple savings accounts, it can stop you from finding a single large balance. And thus save you from the temptation of excessive spending. But you may want to set up automatic transfers to ensure that your savings account keeps growing.

One of the smart ways to save money automatically is to set up your regular transfers from your checking account to your savings accounts. Keep transfer funds weekly, monthly, every other Tuesday, or according to any schedule you prefer. Alternatively, you can use apps such as Digit or Dobot to automate transfers into a separate savings account.

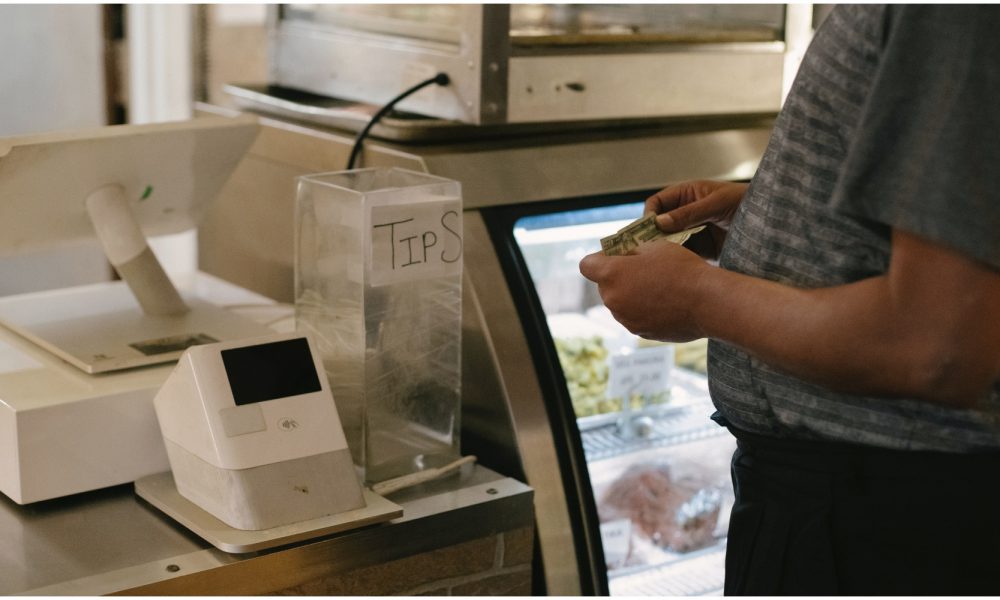

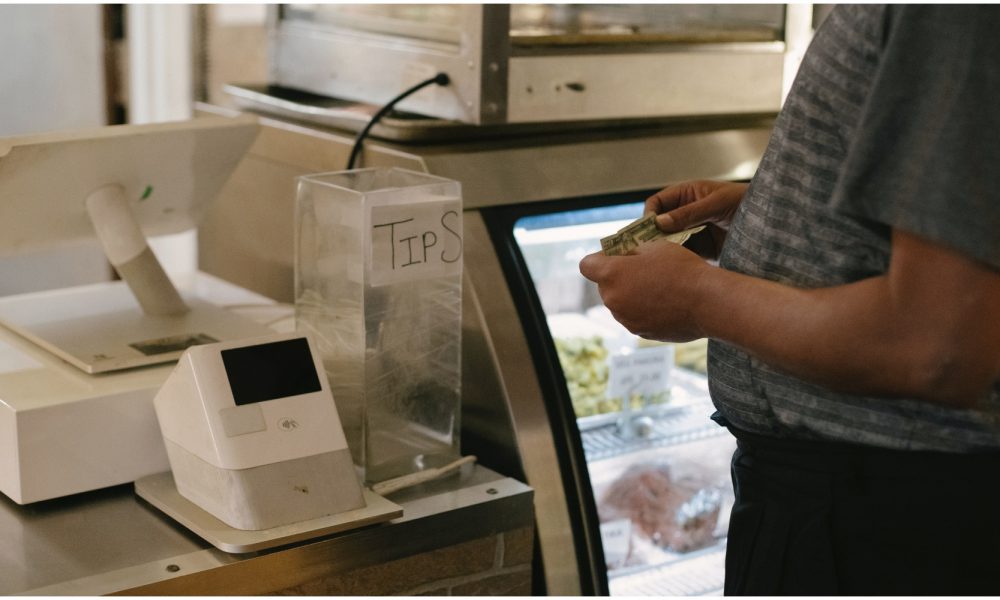

Stop Yourself From Misspending.

If you only have one savings account with a lump of money sitting in it, you may be tempted to spend it. Having all the money in one place can make you spend more and enable you to access the funds with a single bank transfer.

On the other hand, if you open multiple savings accounts, each account’s balances will be lower, making it harder to spend the extra money. It can also cause barriers when you spend your money, especially with multiple bank accounts.

You can use the money a few days after transferring it from one account to another. That’s because the money transfer takes a few days and you would not have access to it. And doing so, ensures you save money for a longer period. These additional steps can help you stay on track and not overspend on other not-so-important things.

Capitalize on Additional Bonuses.

One common strategy that banks usually employ to draw in new customers is to offer extra bonuses to people who open new savings accounts. Usually, if you want to earn a bonus from a savings account, you may need to open an account and maintain a certain amount of balance for some time. These bonuses can amount to hundreds of dollars, so they’re certainly worth looking into it.

Open savings accounts at multiple banks to allow you to earn more than bonuses. You can use the money you earn to ensure you are and work towards your savings goals.

Handling multiple bank accounts can make your finances get a bit more confusing. Ensure you keep track of your different bank accounts, including what you are earning and how you are spending your money. Doing so will ensure you are financially secure. You can also consult a professional financial advisor to understand how you can manage your finances with multiple bank accounts.

More in Big Bank Accounts

-

`

After Password Sharing, Netflix Is Now Struggling With a New Problem

Netflix, the titan of streaming services, is grappling with a new challenge. In the wake of its password-sharing crackdown, the company...

November 27, 2023 -

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login