Why Home Equity Loans are Booming in 2023

Home equity loans, also known as second mortgages, have become increasingly popular in recent years, and this trend is expected to continue in 2023. Several reasons for this boom include low-interest rates, a strong housing market, and an increasing demand for home renovation projects. Here are some reasons why home equity loans are becoming a popular financial tool for homeowners, along with the involved risks.

Low-interest rates

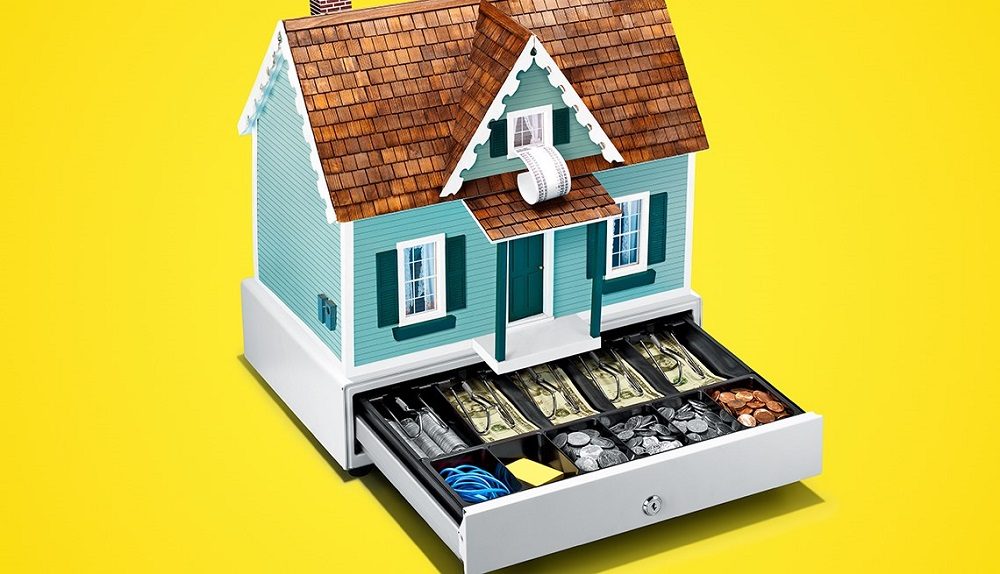

Pipa/ Shutterstock | Loans can allow you to tap into the equity of your home, but they carry risks

One of the main reasons for the growth in home equity loans is the current low-interest rates. The Federal Reserve has kept interest rates low in recent years to support the economy during the pandemic, making it an attractive time for homeowners to take out a home equity loan. With low-interest rates, homeowners can access a large amount of cash at a lower cost, allowing them to fund various projects, including home renovations, debt consolidation, and more.

Strong housing market

Another factor contributing to the growth in home equity loans is the strong housing market. The rise in home prices has increased the amount of equity homeowners have in their homes, making it easier for them to access this equity through a home equity loan. The robust housing market also means a greater demand for home renovations, driving the popularity of home equity loans for this purpose.

Increasing demand for home renovations

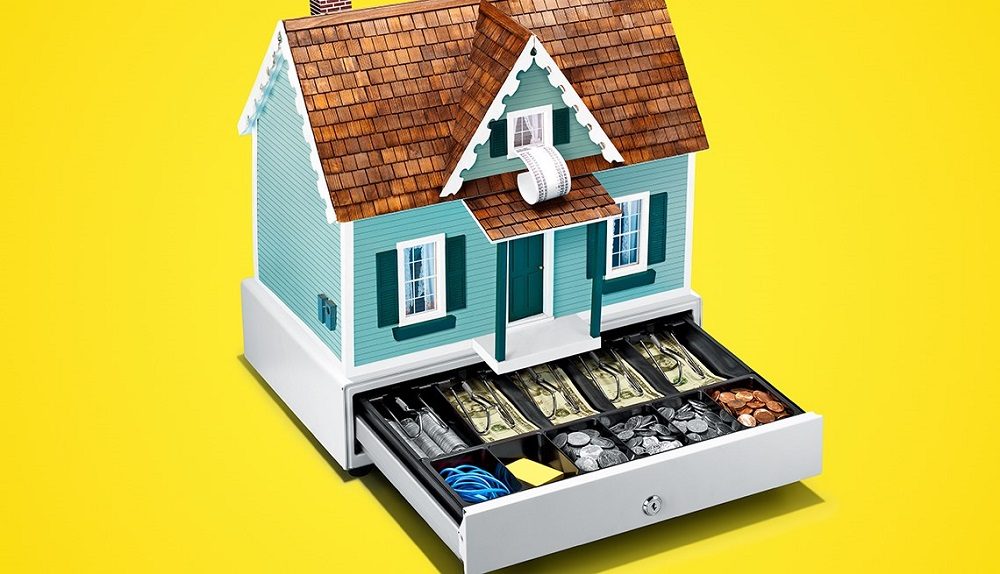

Mark Henricks/ Maxpexels | Home equity loans are heating up,

The increase in home renovation projects has also fueled the growth in home equity loans. Many homeowners are taking advantage of the low-interest rates and strong housing market to upgrade their homes, adding features like new kitchens, bathrooms, or outdoor spaces. Home equity loans are an attractive option for funding these projects because they allow homeowners to access the equity in their homes without having to sell or refinance.

Flexibility

Another reason for the popularity of home equity loans is their flexibility. Unlike other types of loans, home equity loans allow homeowners to use the funds for various purposes, including home renovations, debt consolidation, and more. Additionally, the interest on a home equity loan may be tax deductible, making it a more cost-effective option than other types of loans.

Ease of approval

Home equity loans are also becoming more popular because they are relatively easy to obtain. Unlike other types of loans, home equity loans do not require a lengthy application process or strict credit requirements. Homeowners who have built up a significant amount of home equity are often approved for home equity loans, making it a convenient and accessible option for funding various projects.

Investopedia/ Getty Images | Apart from mortgage loan, home equity loan is a good option when taking a loan

Risks and considerations

While home equity loans offer several benefits, it’s essential to be aware of the potential risks involved. One of the main risks is that your home may be foreclosed upon if you cannot repay the loan.

Additionally, taking out a home equity loan can increase your debt load and decrease your overall equity in your home. Before taking out a home equity loan, it’s essential to carefully consider your financial situation, your ability to repay the loan, and whether it’s the right choice for you.

More in Loans & Mortgages

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login