Here’s How Joining a Credit Union Can Benefit You!

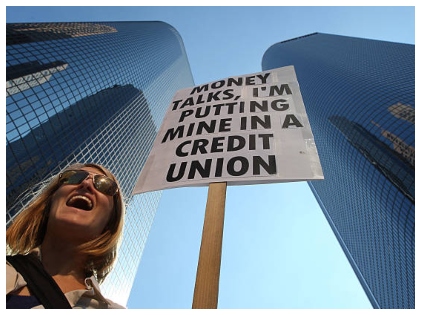

It’s the small decisions that may help you charter a financial path. While there may be various ways to save money, such as carrying a credit card balance and pay off it full each month or spending much lesser than you earn or keeping the housing costs to a minimum, and find out various other ways to find out how your money works for you. Today you don’t depend on your fixed deposits to bail you out during rainy days, you may have other options to explore. Among these options, the credit union is one option that you can certainly try. Here are the benefits of opting for the credit union.

It’s the small decisions that may help you charter a financial path. While there may be various ways to save money, such as carrying a credit card balance and pay off it full each month or spending much lesser than you earn or keeping the housing costs to a minimum, and find out various other ways to find out how your money works for you. Today you don’t depend on your fixed deposits to bail you out during rainy days, you may have other options to explore. Among these options, the credit union is one option that you can certainly try. Here are the benefits of opting for the credit union.

Credit Unions Give You The Importance

As per the conventional rule, a bank lets the customer in, make deposits, take out loans, and make investments. The bank then sets the rules regarding the interest rate and whether customers must carry a minimum deposit. Credit unions shattered the age-old rule by including each customer as the shareholder.

When you become a part of a credit union, you also become a part-owner, along with others. As a shareholder, you can decide how the credit union can operate and participate in the credit union. You can join a credit union in various ways, such as being a volunteer and becoming part of the board of directors. Or become an active voter and proposition new ideas. Also, one member equates to one vote. Even if you have just $10 in your checking account, you will have a say as much as someone who has hundreds of thousands in their account.

Saves You Money

It is the members who form and govern the Credit unions or not-for-profit. Since you are an active member who has a say, the credit union ensures you are happy in remaining so. There is a difference between credit unions and banks as Banks earn money through the interest they charge on loans and fees on things like monthly maintenance or making the most of the out-of-network ATM.

This ensures a sizeable profit to the bank stockholders. The return on the investment will cater to their needs and keep them happy in the process. If you are a credit union member, you’ll get the profit earned by you via low-interest rates on loans and money market accounts. (MMAs). Being part of credit unions can help you save money as you share an ATM network with different credit unions across the country.

Insured Deposits

Credit unions can give you ample peace of mind. Many people think that credit unions are often a safer option than a bank. Credit union accounts can get similar coverage through the NCUA. Credit unions may offer similar protection to retirement accounts like IRAs and trust accounts.

Much like banks, credit unions can fold, but that usually means they will merge with another credit union. Whatever may be the outcome of the credit union. The members will get protection under NCUA insurance. If an insured credit union happens to fail, members can receive payments for the deposits within a spate of a few days.

Promises Friendliness and Accessibility

Big banks can often seem cold and formal and sometimes inaccessible. Very often, the branch managers may not have the authority to make the decisions to offer you help. And in some other instances, banks become so enormous that you become unimportant as an entity.

Credit unions are established by people who have something in common. It either may be a particular type of job, union membership, or in some cases, a shared alma mater. This may even be because they share a common county. Also, a credit union is for everybody and everybody. If you are looking for a credit union that’s federally insured and caters to your needs, NCAU can help you find a credit union locator near you.

Choosing the right financial institution may seem like a big deal for most people simply because many options exist. You may choose a bank where you will be treated with respect, offer you the best interest rates, and help manage your money a whole lot little easier. However, make sure you do ample research on the various credit union options available before you make a pick!

More in Big Bank Accounts

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login