Building Better Business Credit

While we all know about the benefits of good credit for personal finance, not many know of its benefits to their business account. If you have a good credit score, on a personal level, you might get a better car, home, vehicle, and personal loans. Similarly, it will be easy to find financial assistance for your business if you have a good financial standing. If it’s the first time you hear of business credit, don’t sweat it! Here are eight ways you can build your enterprise’s confidence.

-

Business Checking Account

Opening a business checking account is an excellent point to start building your business’s credit. There are many options to choose from. They have different features like monthly transaction benefits, cash deposit limits, access to an expert for advice, and even business efficiency tools. Speaking to an agent can help you identify which is most suitable for your business needs.

Opening a business checking account is an excellent point to start building your business’s credit. There are many options to choose from. They have different features like monthly transaction benefits, cash deposit limits, access to an expert for advice, and even business efficiency tools. Speaking to an agent can help you identify which is most suitable for your business needs.

-

Business Line of Credit/ Credit Card

Banks generally offer something called revolving business lines of credit. This lets you draw from your account for funds or to make business purchases. Repayments on these types of lines of credit are typically also flexible, and your credit availability replenished with every payment that you make. A business line of credit is a good option for purchasing inventory or for financing receivables. You may use it for addressing working capital needs. Your business credit builds with each repayment.

-

Register the Business

There’s no point in trying to build your business credit if you did not register your business! You will have to file your business with the state to get recognition as a business entity. Besides getting a good credit score and financial support, it is also essential to ensure your business has a legal address. You can find ample guidelines on how to register a Limited Liability Company (LLC), or other business entity as per the law of your land. This can save your business a lot in terms of consultation fees with an attorney!

-

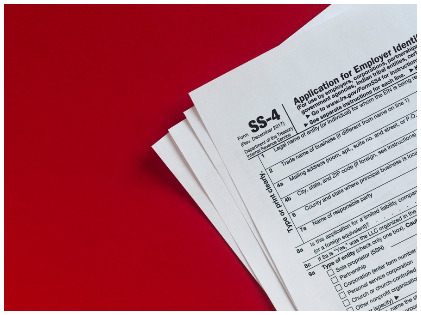

Obtain Employee ID Number

When your business has an employee number, it is evidence that it is an established enterprise. This is especially important when building business credit. Think of the Federal Tax ID, or the EIN, as something of a Social Security number for your company. You will need this number if you wish to change your business or a corporation. Similarly, you will also need it for opening a business bank account, or for signing business contracts.

When your business has an employee number, it is evidence that it is an established enterprise. This is especially important when building business credit. Think of the Federal Tax ID, or the EIN, as something of a Social Security number for your company. You will need this number if you wish to change your business or a corporation. Similarly, you will also need it for opening a business bank account, or for signing business contracts.

-

Pay Bills Timeously

It is essential to pay bills on time if you are working on building positive business credit. This is an obvious step that works the same way as your personal credit score does. However, it includes payments like rent, salaries, vendors’ chargers, and any other miscellaneous business. Doing this will ensure that no amounts reach the credit bureaus.

-

Establish Credit With Reporting Vendors

Timely payments to suppliers and vendors can boost your credit score better than any other business effort. Several vendors report to credit bureaus and when your business has positive credit. It will not just help your business have a great credit score, but will also help you foster positive relationships with your vendors.

-

Accept Credit Card Payments

A simple move like accepting payments through credit cards can boost your business’ credit score. Using a merchant processor that sends reports to the bureau will help you if this is an approach you wish to take. But make sure you discuss this with your potential providers before you settle on a merchant or service provider.

A simple move like accepting payments through credit cards can boost your business’ credit score. Using a merchant processor that sends reports to the bureau will help you if this is an approach you wish to take. But make sure you discuss this with your potential providers before you settle on a merchant or service provider.

-

Watch Your Credit

It is important to watch your business’ credit score just the way you would watch your personal credit. This will ensure that your profile is up-to-date, has accurate information, and there are no errors in your credit rating. Should there be any issues, you can take the necessary action to correct them.

Good business credit is necessary if you need financing assistance. While most businesses get finance with ease even without a good credit score, what they do not tell you is that they had to borrow at a higher rate of interest. If you require some new infrastructure, staff, or other services, the funds will come easy to you if you have creditworthiness. However, it is not hard to build if follow these steps to ensure that your business has the best credit score. It will thus prepare you for a rainy day!

More in Business & Finance

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login