These Are Some Hurdles That Could Derail Your Retirement Plans

So, you’ve planned yourself out well for retirement, you’ve covered all your expenses and calculated your medical fees and emergency fund. You even have some money for siling yourself and maybe even a few plans on what you will be doing in your spare time. Well, life has a funny way of throwing curveballs at you sometimes. And there are some situations or challenges that may present themselves after you retire, which you might not be ready to face. Here are some of the most common curveballs you need to prepare yourself for, whether you like it or not!

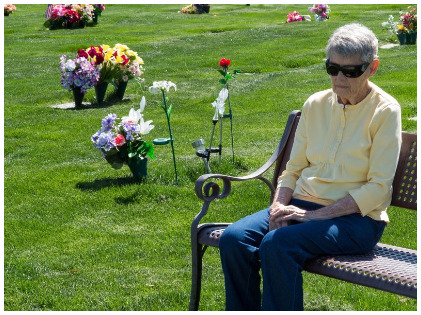

Spouse Death

When you’re planning your retirement, you don’t typically consider what would happen should your spouse happen to die. Grief over the death is one thing on its own, but the other thing is that your plans are likely going to need reshuffling, especially if you are dependant on your spouse for care.

If the spouse who usually handles finances dies, the spouse left may be unable to manage. Fortunately, the financial industry has developed financial products that help to support the survivors of deaths in the family in terms of income and sometimes even therapy.

Separation or Divorce

While it is true that the divorce rates among older couples are far lower than that of younger couples, divorce or separation is still a risk you do face. Especially since retirement itself is a lifestyle change that may bring with it some adjustments and new challenges. Not to forget the discontentedness or frustration that can place strain on a couple who have been having a comfortable lifestyle for several decades. Splitting of marital assets impacts financial security and the standard of living for retired couples. It is common for retired couples to plan their retirement by pooling incomes and cash flows, which makes this even more risky of a situation.

Unforeseen Family Needs

It is not uncommon for retirees to find that family members turn to them for financial help, including siblings, children, and grandchildren. The family may require more significant financial support. In case of events like changes in employment, health, or even marital status anywhere along the line, you might need more money.

For example, a son getting divorced or a sibling coming down with an illness that renders them disabled or unable to work, you might face money issues. There are so many examples of this occurring, and retires find that they have planned their finances perfectly for themselves, yet they need to support others with their limited resources now.

Terminal Illness

There is a lot of lifestyle change that comes with a terminal illness, and having a medical aid is not the only consideration to give should this situation arise. Medical assistance will help to cover any costs that would otherwise eat into retirement savings. Still, it is essential to recognize the hidden costs that come with being diagnosed with a terminal illness, whether it is you or your retired spouse. You might need caregivers and depending on the severity of the disease, maybe even a place of care. The home you currently live in may not be suitable for a person who has limited mobility or needs additional space for wheelchair use of medical equipment.

Financial Risks

Inflation and increasing interest rates may not seem very threatening to someone preparing for retirement. But only when you sit down and calculate the real figures that small increases in interest and inflation has on your finances that you realize that over time it can present a real problem. Overlooking this could spell trouble as you rely on the same income offering you the same lifestyle in a decade or two to come.

The longer the time you have spent in retirement, the more difficult it is to remain confident with your finances. Understanding the risks of what you may face is essential so that you don’t find yourself in a predicament where your financial security is at risk. Even the best retirement plan faces the risk of being derailed in the event of unforeseen circumstances. You can’t predict the future, but you can prepare for what you can! Don’t risk outliving your savings – have a plan in place for each of these risks, so should they spring up, you can fight back!

More in Business & Finance

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login