How To Be A Personal Finance Ninja At A Young Age

Getting into the real world is one of the most exhilarating times in an individual’s life that remains etched in our memories forever. Crossing over the boundary of school to the adult world, getting appointed to your first job, and going out into the world on your own are some milestones that no one forgets. These signal the inception of adulthood and finally the end of being called a kid. Although the prospects of adulthood are unfamiliar but wonderful, the excitement wears off soon enough, and you end up getting punched in the face when reality strikes. Managing your finances is not as easy as it looks.

Why Is It Difficult?

Having a realistic budget and learning the ways of spending money properly in the initial phase can prove to be challenging for an individual. And there is every probability that you will make blunders. To ensure a smooth transformation and pull through real-time budgeting, you need to go through the following tips.

Get To Know What’s Your Take-Home Salary

When you receive your first job, you get a salary offer. For instance, you might make around $30,000 a year. So does that imply you are taking home an approximate $2500 a month? No!

When you receive your first job, you get a salary offer. For instance, you might make around $30,000 a year. So does that imply you are taking home an approximate $2500 a month? No!

When you get hold of your first paycheck, you will get to know that a lot of expenses such as social security income, state and federal taxes, and health insurance have been deducted, and this can amount to a sizeable percentage of the gross pay.

It’s imperative to be aware of your take-home salary so that you can chalk up an estimated budget.

Realize Where You Need To Spend Your Money

Living all by yourself, way away from your parents, can prove to be hard. You suddenly realize that you are shelling out money for stuff you didn’t spare a thought on before. Ensure that you identify the areas where you need to pay out and all those little things that are a necessity.

Living all by yourself, way away from your parents, can prove to be hard. You suddenly realize that you are shelling out money for stuff you didn’t spare a thought on before. Ensure that you identify the areas where you need to pay out and all those little things that are a necessity.

For example, make sure that you save around 30 percent of your total income to disburse rent. Though that can depend on where you are residing, that figure is more than enough.

Aside from that, you need to consider your food expenses which might cut a big hole in your pocket. Make a list of all the required items every week before you hit the local grocery shop. Make the budget as detailed and cost-efficient as possible.

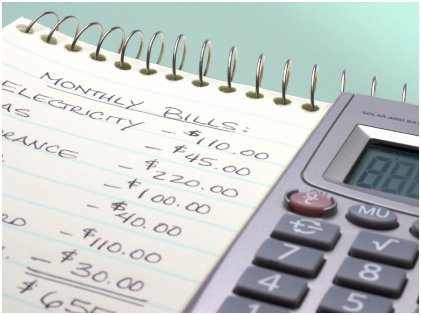

It’s Important To Stay Organized

Organizing your finances is an essential factor in case you want to restrain yourself from overspending. Track down all your expenditures and once you are done with that, identify the areas you need to cut back on.

Organizing your finances is an essential factor in case you want to restrain yourself from overspending. Track down all your expenditures and once you are done with that, identify the areas you need to cut back on.

Most people tend to overlook trifle things, but those can add up in the days to follow. Make a spreadsheet to input all your expenses.

You can also integrate certain tools with your credit card and bank accounts so that you can keep a tab on all your expenses.

There’s a slew of smartphone apps that can help you to stay organized.

Saving Money Should Be Of Utmost Priority

Staying alone for the first time can be exciting and challenging at the same time, and youngsters normally develop an inclination to spend money on things they fancy. But living your day according to the limited means you have is of utmost significance.

Not abiding by a strict budget will lead you to face tougher times in the future, and you might get into unforeseen trouble. Imbibing good financial habits will only benefit you shortly. Save money as much as possible.

Here is another piece of advice that you can adhere to. Keep an emergency fund aside. Nobody has seen the future and you don’t know what’s coming up. This emergency fund will come to your aid when you have all the doors closed on you. It won’t be early at all to contemplate what’s life going to be like after retirement. If you start planning for it from now on, you are the only one who is going to reap the dividends. The power of compound interest is immense and the sooner you start saving in your emergency fund, the smoother will be your road in this long journey called life.

More in Business & Finance

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login