How Many Bank Accounts Should You Really Have?

People generally open savings accounts for their savings routine and a checking account for their disposable income and also to avoid ATM withdrawal charges. However, if you think you are the only one to have too many bank accounts under your belt, you are definitely not alone. Especially if you are self-employed or a freelancer who works on a full-time basis, you may get confused as to how many bank accounts you should really have. Financial experts have come ahead with some valuable suggestions on exactly how many bank accounts you should actually possess and the types of bank accounts suiting the banking needs of professionals and business owners. Read on to know more.

Try To Keep Things Simple

Simplicity has its own value. It will be in your best interests if you have one savings account and a checking account along with it. A checking account helps you manage your day to day expenditures and a savings account helps you hold your money for the future. With that being said, your checking account must have an ample amount of cash if you want to sleep peacefully at night and pay off your bills at the right time. Online banks such as Capital One 360 don’t charge any fee and offer quite a high interest on your savings and checking. Not much benefit can be derived from complicating things. You can make use of another account if you wish to set aside funds for some very specific purposes. In case you are married, you might have a joint account as well. Aside from these, any more accounts will be tough to manage and make you confused.

Simplicity has its own value. It will be in your best interests if you have one savings account and a checking account along with it. A checking account helps you manage your day to day expenditures and a savings account helps you hold your money for the future. With that being said, your checking account must have an ample amount of cash if you want to sleep peacefully at night and pay off your bills at the right time. Online banks such as Capital One 360 don’t charge any fee and offer quite a high interest on your savings and checking. Not much benefit can be derived from complicating things. You can make use of another account if you wish to set aside funds for some very specific purposes. In case you are married, you might have a joint account as well. Aside from these, any more accounts will be tough to manage and make you confused.

Which Scenarios Require You To Have Additional Accounts?

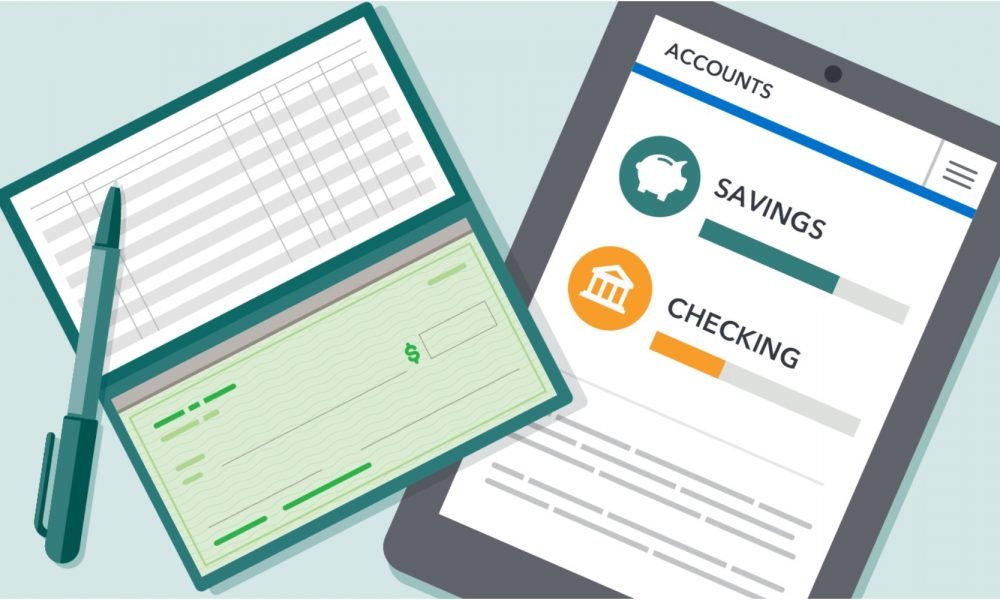

Certain situations demand an extra savings account. If you are a freelancer and don’t rake in a steady sum in your bank account, you might need to fake a paycheck that seems to be steady. In such a scenario, get hold of a savings account where you can store up your income. Then transfer a certain amount of money to your checking account for your monthly expenses. If a big tax bill is expected at the end of the financial year, put aside a particular sum into your savings account and pay your taxes from there. For annual insurance premiums, trips, or holidays, you can definitely have an additional savings account. This will help you set a particular amount aside. If your checking account has some extra cash, it will look after your financial goals in terms of crisis.

Certain situations demand an extra savings account. If you are a freelancer and don’t rake in a steady sum in your bank account, you might need to fake a paycheck that seems to be steady. In such a scenario, get hold of a savings account where you can store up your income. Then transfer a certain amount of money to your checking account for your monthly expenses. If a big tax bill is expected at the end of the financial year, put aside a particular sum into your savings account and pay your taxes from there. For annual insurance premiums, trips, or holidays, you can definitely have an additional savings account. This will help you set a particular amount aside. If your checking account has some extra cash, it will look after your financial goals in terms of crisis.

If You Are An Entrepreneur

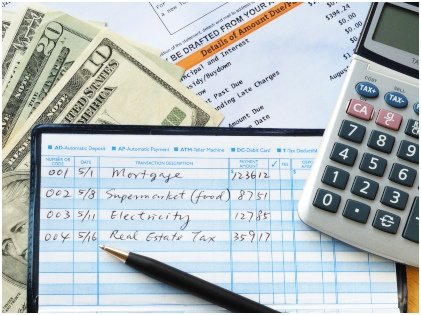

You must draw a line between your personal expenses and business, especially if you are the only proprietor. In the initial stages, a single checking account for your business would serve your purpose. As time goes by, you might like to open a savings account in order to have a separate cash reserve other than the budget that you have set for the operation of your business.

You must draw a line between your personal expenses and business, especially if you are the only proprietor. In the initial stages, a single checking account for your business would serve your purpose. As time goes by, you might like to open a savings account in order to have a separate cash reserve other than the budget that you have set for the operation of your business.

When Is Having More Than One Bank Account Beneficial?

If you tend to spend the entire amount from your checking account every month, then having a number of savings accounts might prove to be beneficial for you. Try to find out the large expenses that you generally have to deal with every year and then start putting money into your savings accounts to cater to these items. Aside from a checking account, a savings account is a must even if you have a trifling amount to save there. If you receive some extra cash, put that away into your dedicated savings account. This will come to your aid when emergency strikes. If you have to shell out fees for having a savings account, then just focus on your checking account until the time you are able to afford both.

If you tend to spend the entire amount from your checking account every month, then having a number of savings accounts might prove to be beneficial for you. Try to find out the large expenses that you generally have to deal with every year and then start putting money into your savings accounts to cater to these items. Aside from a checking account, a savings account is a must even if you have a trifling amount to save there. If you receive some extra cash, put that away into your dedicated savings account. This will come to your aid when emergency strikes. If you have to shell out fees for having a savings account, then just focus on your checking account until the time you are able to afford both.

It all boils down to your personal banking needs, preferences and your specific financial goals. You need to find out what suits you best and helps you keep an account of your savings and other financial objectives. Whether you should open additional accounts totally depends on what kind of a financial situation you are going through right now. But, the top banks can surely organize things just like the way you have always wanted.

More in Big Bank Accounts

-

`

Why 50-Year-Olds Are Looking for a Career Change

In today’s fast-paced and ever-evolving job market, it’s not uncommon to see individuals in their 50s embarking on new career paths....

November 20, 2023 -

`

Why Mortgage Demand Is Crashing as Interest Rates Skyrocket

Imagine having a favorite local ice cream shop that suddenly jacked up its prices by 50%. You would probably think twice...

November 18, 2023 -

`

Santo Spirits | Sammy Hagar and Guy Fieri’s Joint Venture

In the world of entrepreneurial partnerships, some unions are destined for greatness. The unexpected alliance between Sammy Hagar, the iconic Van...

November 12, 2023 -

`

Branded Content: A Genuine Way to Connect With Your Audience

Have you ever binge-watched a series on Netflix, only to later realize that the beverage everyone’s sipping on is that brand...

November 3, 2023 -

`

Southwest Airlines Tackles Passenger and Labor Challenges

Southwest Airlines, a prominent player in the aviation industry, has found itself at a crossroads, facing a combination of passenger dissatisfaction...

October 28, 2023 -

`

Everything You Need to Know About Blended Interest Rates

Hou ever blended a smoothie and thought, “How on Earth do my strawberries, spinach, and protein powder come together to taste...

October 17, 2023 -

`

The Osbournes ‘Relaunch’ Podcast After 5 Year Break

If you were glued to your TV in the early 2000s, there is no way you missed the hilarious, raucous, and...

October 10, 2023 -

`

Tesla in China: Back-to-Back Price Drops, But No Sales Jump?

As temperatures soared in the summer of 2023, Tesla seemed to be heating things up in the Chinese market too. A...

October 6, 2023 -

`

Navigating Red Flags in the Workplace

In the journey of our careers, it’s not uncommon to encounter red flags in our jobs that signal potential issues or...

September 30, 2023

You must be logged in to post a comment Login